Money Manager

Say Hello to Smart Finances

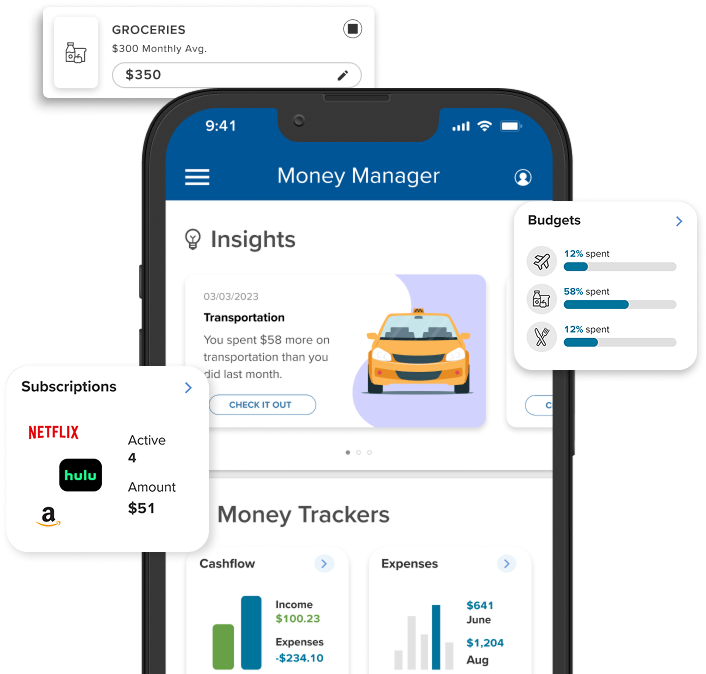

Why pay for a money tool? Money Manager is a free tool inside Online Banking and helps you save, budget and track expenses easily. With simple tips and insights, it helps you stay on top of your finances and gain confidence.

)

Built-in intelligence gives you personalized insights

Personalized just for you, these data-driven notifications identify ways to:

- Maximize saving

- Keep you updated on deposits

- Alert you to upcoming subscription renewals

- Inform you of suspicious transactions

Take Charge: Track, Visualize, and Control Spending

Forecast Activities and Balances

Receive snapshots of expected upcoming activity to your accounts and get notified about potential low balance amounts in the upcoming weeks.

Organize and Track Transactions

Track your spending and cash flow by filtering transactions by account, month, incoming, outgoing, and transaction category.

Helps Visualize Spending

Analyze your spending patterns, making it easy to spot trends and areas for improvement.

Control Spending with Budget Tracking

Easily track progress on your budget and receive milestone notifications, helping you stay motivated and accountable.

Manage Subscriptions and Avoid Surprises

Track all your subscriptions, avoid any surprise charges, spot unused services, and get reminders before renewals. It's a simple way to save money and stay on top of your budget effortlessly.

)

Meet Your Goals: Financially and Personally

Set, track, and hit your savings goals. Whether it’s a rainy day fund or a dream vacation, Money Manager makes it easy.

- Multiple Categories: Choose from a variety of goal types like Travel, Emergency, Home, or Debt Payoff.

- Fully Customizable: Don’t see the perfect fit? Create your own goal category to match exactly what you’re saving for.

- Set a Date Range: Define your target by date to create focus and motivation.

- Connect a Savings Account: Select which of your accounts will act as the hub for this goal, making it seamless to track progress.

- Track Real-Time Progress: See real-time progress toward your goal to stay motivated and informed.

- Flexible & Dynamic: Adjust your date range, goal amount, or even the savings account because life changes, and so can your plans.

Enjoy for Free Within Online and Mobile Banking!

Don't have our mobile app? Download our Mobile Banking App today and enjoy better banking!

To download the mobile appdisclosure 1, follow the links below.

4.9

Apple App Store

4.8

Google Play Store

Money Manager FAQs

Money Manager comes ready to use for all Online and Mobile banking customers! There is no enrollment process, so you can start using all the features right away.

Yes! You can change the category to your preference or add a customized tag by following these steps:

- Select the transaction from the Insight or Tracker.

- Click the Pencil icon next to the category.

- Choose a new category from the list and apply your changes. You can choose to apply to either one transaction or all similar transactions.

- To add a customized tag, select the transaction and click "Add Personal Tag".

Find your Money Manager tools on the Account Summary page! You can also find it under the Money Manager tab in the menu.

Yes, you'll be able to connect external accounts within Money Manager to get a complete view of your finances.disclosure 2

Insights are triggered by a number of different behaviors and transactions. If there are no transactions or certain behaviors occurring with the account, no Insights will be triggered. Remember, the more you engage with any Insights, the more likely you are to receive new, more custom Insights!

Not at this time. Money Manager will automatically alert you through relevant Insights that you can view from the Accounts Summary page, as well as the Money Manager dashboard.

You can set up a number of Mobile Banking alerts separate from Money Manager by navigating the menu bar to the Alerts tab.

Yes! When an external account is connected through Money Manager, you are giving the tool permission to track the transactions on the connected account. This helps provide more accurate suggestions by the Insights.

-

Mobile carrier data and text rates may apply. Back to content

-

Some financial institutions or accounts may not be viewable. Back to content