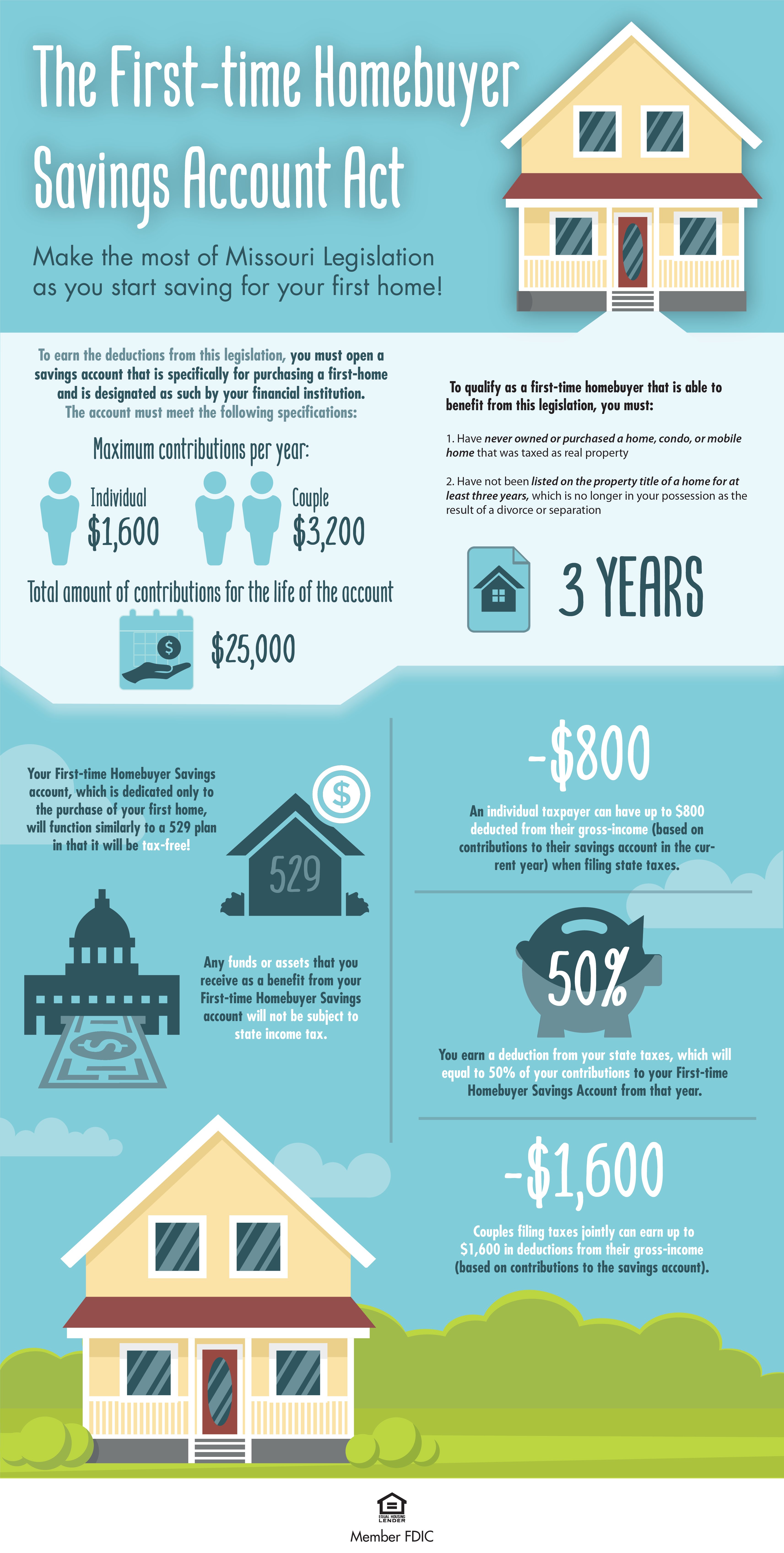

The First-Time Homebuyer Savings Account Act and what it means for you

As of July 13, 2018, Governor Mike Parson moved forward a legislation impacting first-time homebuyers. The First-Time Homebuyer Saving Account Act offers state income tax deductions to those using a savings account dedicated to saving for a first home purchase.

Check out our guide below to learn more about The First Time Homebuyer Savings Account Act and exactly what it means for you. It’s important to understand the basics as you start to save for your first home.