Mortgages 101: Fixed rate vs. adjustable [Infographic]

Realistically, few people have hundreds of thousands of dollars sitting in a savings account to be used for a home purchase. After saving for the recommended 20 percent down payment, you will need to cover the remaining cost of the home, resulting in the need for a mortgage loan.

For new homebuyers, taking out a home loan can be an exciting, if not a somewhat scary experience. Like paying rent, you will make monthly payments on your mortgage, which will include interest. As such, you may be looking for stability in your mortgage. This is important to keep in mind when you're deciding how much money to borrow.

Experienced buyers may be in the market for a different type of mortgage, perhaps one that reflects the ability to easily sell their home in the case of a quick move due to job changes or simply the excitement of moving.

Luckily, there's a mortgage for both types of homebuyers.

Fixed rate

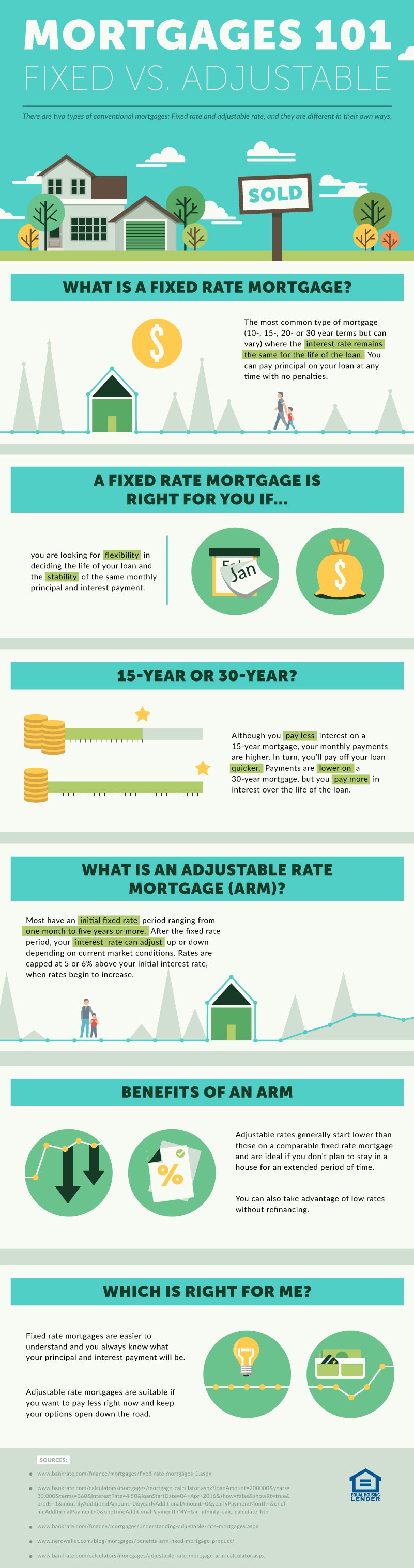

A Fixed-Rate Mortgage (FRM) is the most common loan homebuyers take out, and it usually comes in intervals of 10, 15, 20 or 30 years. With this loan, interest rates remain the same throughout the life of the mortgage.

A FRM is best if you want stability by knowing the exact amount you will be paying on a monthly basis. As for the term of the loan, 15-year FRMs have less interest, but higher monthly payments, which is the opposite of a 30-year FRM.

Adjustable rate

Adjustable-rate mortgages have an initial fixed rate for typically the first month to five years or more. Once that period is up, interest rates can increase or decrease depending on current market conditions, although there is a cap of 5 to 6 percent above your initial interest rate.

In the right conditions, you may pay less in monthly payments. But if interest rates in the market increase, so too will yours, which will result in higher monthly payments.

Which should I get?

An ARM is ideal if you want to buy a home but don't envision yourself living in the area for the rest of your life. This provides you with some flexibility.

A FRM is easier to understand because you know what your monthly payments will be for the duration of the loan. If you take out a loan at just the right time, you are able to take advantage of low-interest rates, even if 20 years from now rates have gone up.

When it comes to getting a mortgage, just remember you have plenty of options available and we are here to help you pick the one that makes the most sense for you.