A roadmap to retirement for millennials [Infographic]

Habits change over the years, from generation to generation. And, let’s face it, millennials will need deeper savings accounts than generations before them in order have an adequate amount of money to live off in retirement.

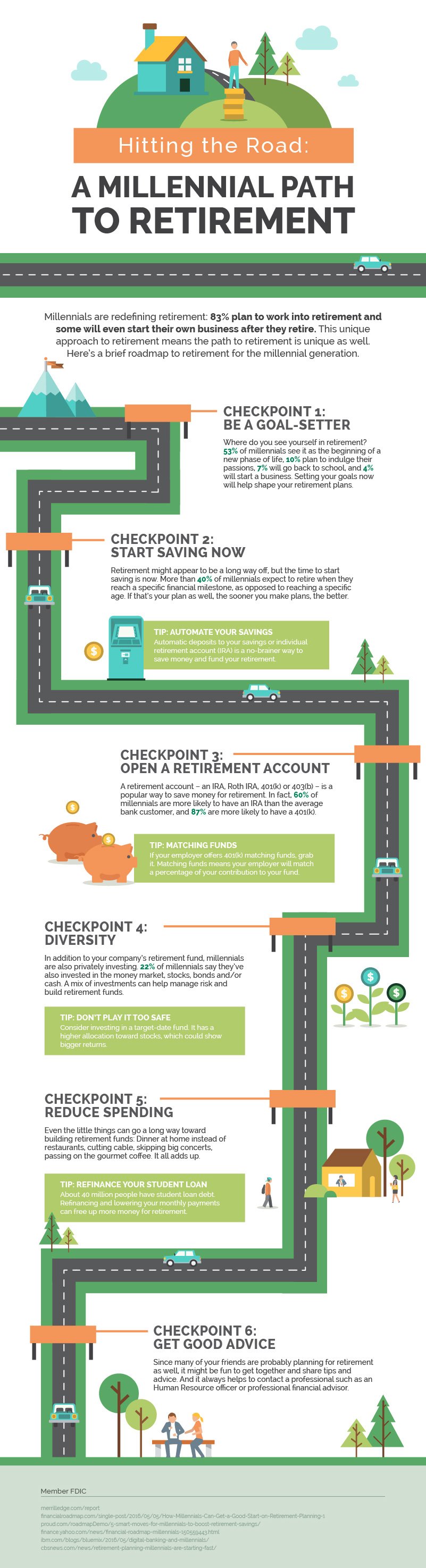

With this wake-up call in mind, here are six steps you should follow in order to have a comfortable retirement.

1. Set Goals: Have an idea of what you want your retirement to look like. Do you see it as the start of a new life phase, the time to live out your passions, go back to school, or even the right time to start a business? It's always beneficial to know what you're working towards so that you can mold your retirement plan around your goals.

2. Start Saving Immediately: It's never too early to start putting money away for your retirement. The sooner you start, the sooner you'll reach your goal. If you're a millennial that wants to retire upon reaching a set financial milestone instead of upon reaching a certain age, that's even more motivation to start saving today.

3. Start a Retirement Fund: This can be an IRA, Roth IRA, 401(k), or 403(b). Some employers offer 401(k) matching funds; if your employer does this, be sure to enroll as soon as you can. This is an awesome savings tool for your future. You don't want to miss out on your employer matching a percentage of what you're putting into your retirement fund.

4. Privately Invest and Diversify: Don't be afraid to invest in a fund outside of your company's retirement fund. Look into the money market - stocks, bonds, and/or cash and do your research. By mixing your investments, you're helping to manage risk and increase your retirement fund even more. The best way to explore your investment options is to talk with a professional.

5. Spend Less: If you reduce your spending now, you'll reap the benefits later. Skipping the daily coffee run and making your coffee at home, trading in eating out for eating in or making your lunch, and cutting your cable to convert to streaming services are ways to make a considerable reduction in your spending habits. You'll love watching your retirement fund grow in the process.

6. Seek Guidance: You aren't expected to be an expert on retirement planning. Your company's HR manager and a financial advisor from your bank are great sources to discuss your options with. Your friends and siblings are most likely in the same boat as you which makes them great sounding boards to bounce your retirement ideas off of.

Although planning for retirement isn't the most exciting thing to do, it's extremely worthwhile. Remember, the sooner you start saving, the better. Your future self won't be able to say thank YOU enough. We would love to assist you with your retirement goals. Stop by any Jefferson Bank location today!